Property Description

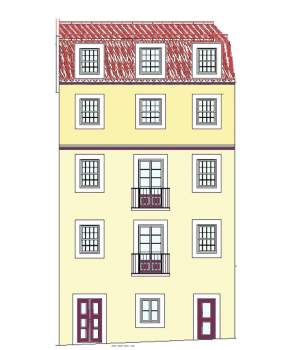

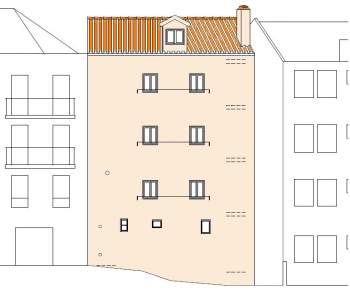

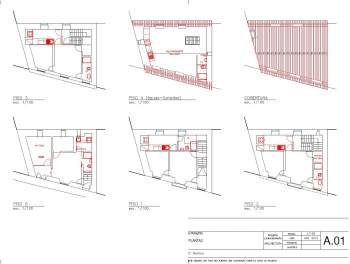

1. Freehold residential building, in the heart of Lisbon, an potential income producing comprising of 6 units (or 5 flats), arranged over ground and four upper floors;2. Five storey building, is good structural condition, for easy refurbishing, for sell all vacant;

3. Located in the inner heart of the historical center of the city of Lisbon, in the attractive and touristy Mouraria district, next to modern and attractive hotel units (future charming 5-star hotel planned for the Rose Palace 50 meters far, and leaning against local accommodation equivalent to a 5-star hotel "Páteo"), and the leaning the luxury development HillSide View (T3 for sale for € 1,495,000 at the present - hillside-view.com/en/the-location);

4. The main factor of its valorization is its privileged location, in a safe, calm and quiet area, 50 meters from a palace (Palácio da Rosa) and its square, and less than 15 minutes walk from: 2 METRO stations downtown; Rossio, Chiado, Alfama charming neighborhoods; and Lisbon Castle;

5. It has 6 units in the building book, which increases its versatility to enhance hotel or tourist accommodation / Local Accommodation. Please see rules and details in the Lisbon City Hall.

6. Your purchase gives you the possibility to apply for a gold visa for Portugal (for details look for: "Portuguese nationality" and "golden visa").

7. Has motor access, through a secure and quiet one way street, with low traffic.

8. The rehabilitation intervention can enjoy the following tax benefits as it is inserted in ARU of the City Council and Lisbon:

IMI - Exemption for a period of 5 years;

IMT - Exemption in the 1st transmission of the rehabilitated property, when intended exclusively for own and permanent housing.

IRS - Deduction to collect 30% of owner-related rehabilitation charges, up to € 500.

Capital Gains - Taxes at a reduced rate of 5% when they are entirely due to the sale of rehabilitated properties in ARU.

Property Income - Taxation at a reduced rate of 5% after rehabilitation works.

IRC - Exemption for income obtained by real estate investment funds, provided that they are constituted between January 1, 2008 and December 31, 2013 and at least 75% of its assets are real estate subject to certified rehabilitation actions.

Taxation at the rate of 10% of units in real estate investment funds, under IRS and IRC and Capital Gains.

VAT rate reduction to 6%

For further details, send us an email. Thanks.

Additional Details

- Living Space 255 m2

- Lot Size 51 m2

- Furnished No

- Garage No

- Central Heating No

- Air Conditioning No

- Garden No

- Pool No